What is a payment ledger?

A payment ledger, general ledger or billing ledger is a record-keeping tool used to track all financial transactions for your property. Think of it as your hotel’s financial diary—logging everything from guest payments to expenses like maintenance and supplies. It’s a must-have for anyone juggling bookings, running operations, and keeping finances in check.

In this blog we’ll teach you all about payment ledgers, so you can gain clarity over your business’s cash flow, making it easier to manage income, expenses, and even tax preparation.

Control your finances, not the other way around, with Little Hotelier.

Want to simplify your finances? Explore how Little Hotelier can help you access data, analyse reports, and create financial records.

Learn moreWhy is a payment ledger necessary in hotels?

Managing finances as a hotelier can feel overwhelming when you’re balancing bookings, guest needs, and operational tasks. A payment ledger simplifies this by providing a clear and automated overview of your property’s financial health. A well-maintained payment ledger can be your secret weapon for smoother operations. Here’s just a few of the benefits:

- Save time: Automating payment tracking reduces the need for manual entries and ensures all transactions and deposits are accurately recorded in real-time, freeing up hours in your day.

- Reduce stress: No more scrambling during tax season; a detailed ledger ensures everything you need is already at your fingertips.

- Stay in control: Maintain a clear picture of your financial health with up-to-date records, making it easier to forecast revenue and address potential shortfalls before they arise.

What is the purpose of the payment ledger in hospitality?

A payment ledger plays a crucial role in managing your property’s finances effectively. It helps you:

- Track all incoming payments and outgoing expenses: Whether it’s guest bookings, platform payouts, or vendor payments, everything is logged to give you a comprehensive view of your cash flow.

- Organise financial data for tax filing: Say goodbye to the chaos of tax season. An up-to-date ledger provides a neatly organised record of your income and expenses, making compliance straightforward.

- Monitor your business’s profitability over time: By analysing patterns in revenue and expenditure, you can identify trends, make informed decisions, and ensure your property remains profitable year-round.

What type of hotel transactions are recorded in the ledger?

Your ledger should include:

- Guest payments: Record detailed information about bookings from platforms like Airbnb, direct reservations, and other online travel agencies (OTAs), including payment dates and methods.

- Expenses: Log all operational costs, such as cleaning fees, routine and emergency maintenance, supply purchases, and service subscriptions for property management tools.

- Deposits and refunds: Keep track of security deposits collected from guests and any refunds issued, ensuring clarity in financial records.

- Recurring payments: Include regular payments like utilities, internet services, and subscription-based software for seamless tracking.

Common challenges property owners face with financial management

Running a property involves more than just managing bookings—financial management often poses its own set of challenges, which can escalate without effective tools and strategies.

Disorganised payment tracking

Missed payouts or forgotten expenses not only lead to confusion but can also cause financial shortfalls, making it harder to plan for future expenses. Keeping track of transactions across multiple platforms without a central system adds to this challenge.

Time-consuming record-keeping

Manual processes require painstaking attention to detail, leaving less time for other critical aspects of your business. For instance, manually tracking payments across platforms can delay response times to guest inquiries, a challenge that a streamlined payment ledger – one that’s in the correct payable ledger format – could eliminate. Cross-checking entries across various payment systems and platforms often results in wasted hours that could be better spent enhancing guest experiences.

Unclear profitability

Without a comprehensive view of your finances, it becomes nearly impossible to gauge your property’s profitability. This lack of clarity can hinder your ability to make informed decisions, leading to missed opportunities for growth.

Stressful tax season

Tax season is stressful enough without the added chaos of disorganised records. Without proper systems, reconciling income and expenses becomes a time-consuming, error-prone task that leaves you vulnerable to compliance issues or missed deductions.

How can a payment ledger be of use to your property?

A robust payment ledger keeps your finances tidy, true, but it also prepares your property for long-term success by making the finances and day-to-day work easier to understand.

Audit process

Ensure compliance with regulations and financial transparency during audits by having all transactions systematically recorded.

For example, a ledger that details income from various booking platforms and corresponding expenses can quickly provide auditors with the clarity they need, reducing delays and ensuring a smooth process.

A well-maintained ledger acts as a safeguard against discrepancies and simplifies the auditing process, saving you time and effort.

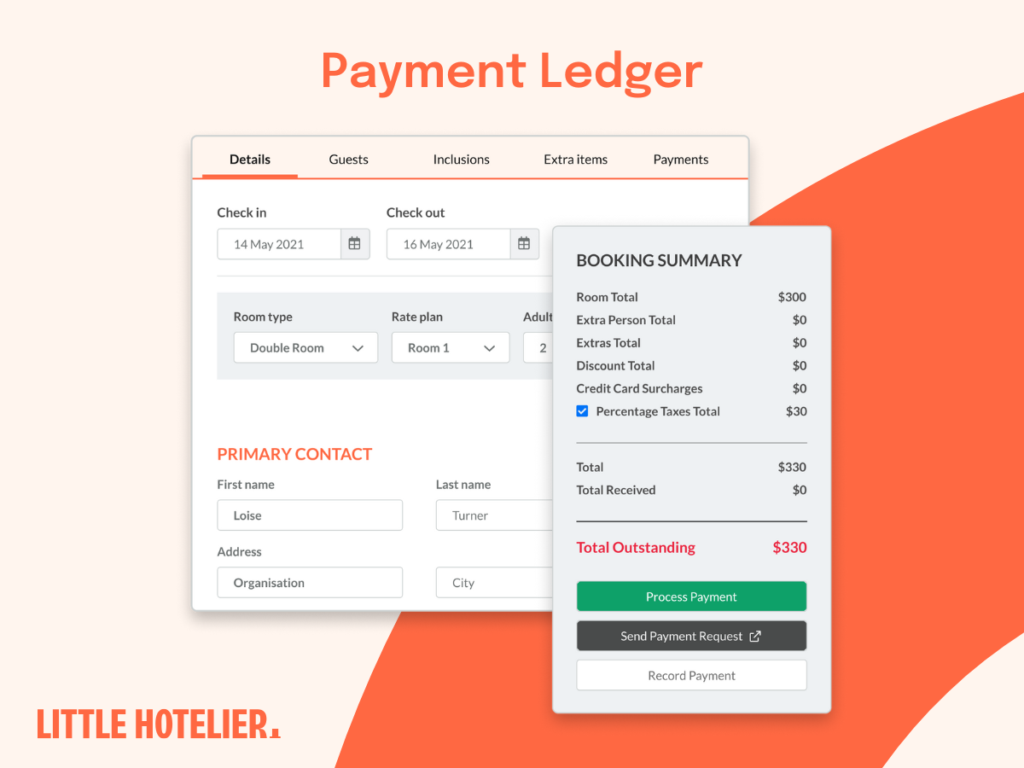

Payments

Easily track what you’ve received and what’s outstanding to maintain cash flow. Whether it’s tracking deposits, reconciling guest payments, or ensuring timely platform payouts, a detailed ledger helps you stay ahead of financial obligations.

Invoice

Keep comprehensive records of vendor payments, guest receipts, and service invoices for effortless reference. A well-organised invoice system not only ensures smoother operations but also builds trust with suppliers and enhances your business’s reputation for professionalism.

Best practices for maintaining your payment ledger

- Log transactions immediately: Avoid forgetting important entries by recording them as soon as they occur. Whether it’s a guest payment or an operational expense, immediate logging ensures accuracy.

- Set aside review time: Dedicate a specific time each week or month to review your ledger. This regular check helps catch errors early and keeps your financial records in top shape.

- Categorise transactions properly: Proper categorisation is crucial for understanding profitability and streamlining tax preparation. For example, separate expenses by categories like maintenance, utilities, or supplies.

- Rely on your ledger for tax filing: When tax season arrives, your ledger becomes an invaluable resource for filing income and claiming deductions. A well-maintained ledger reduces the stress of gathering documents at the last minute.

- Back up your data: Ensure your ledger is stored securely using cloud-based platforms like Google Drive or Dropbox. This precaution protects your records from accidental loss or damage, providing peace of mind.

By Dean Elphick

Dean is the Senior Content Marketing Specialist of Little Hotelier, the all-in-one software solution purpose-built to make the lives of small accommodation providers easier. Dean has made writing and creating content his passion for the entirety of his professional life, which includes more than six years at Little Hotelier. Through content, Dean aims to provide education, inspiration, assistance, and, ultimately, value for small accommodation businesses looking to improve the way they run their operations (and live their life).

Table of contents

“Our accommodations are perfectly taken cared of, thanks to Little Hotelier. It's now easier to get real-time info! Payments are easily traced too.”

General Manager, Marina View Chalets

Jonathan Kaye,

Operations Director

Cedar Manor